Fund Management is a structured solution that allows traders to allocate and manage capital across multiple accounts through a centralized strategy. It is designed for traders who want to scale their trading operations, streamline execution, and ensure consistent strategy performance across connected accounts.

How Fund Management Works

• Centralised Strategy Execution

Trades are executed through one primary strategy account. Once the trades are closed, the results (profit or loss) are allocated proportionally across all connected accounts based on predefined allocation rules.

• Automated & Transparent Allocation

The allocation process is handled automatically, providing fairness, accuracy and transparency. No manual intervention is required, ensuring consistency and operational efficiency.

• Unified Risk & Strategy Framework

All connected accounts follow the same strategy and risk profile. This creates a controlled, disciplined trading environment while allowing the trader to scale their performance across a wider capital base.

In Fund Management trading, a fund manager operates from a single strategy account. Investors allocate capital to this strategy, and all trades are executed centrally. Once the trades are closed, profits or losses are distributed proportionally to each investor based on their share of the total equity.

Yes, FXTRADING.com is a fully regulated brokerage holding multiple licenses, including authorization from the Australian Securities and Investments Commission (ASIC). This ensures a secure, transparent, and compliant environment for your Fund Management activities and all related trading operations.

Our PAMM platforms are fully compatible with Expert Advisors (EAs). This allows money managers to deploy automated and algorithmic trading strategies efficiently across all their managed accounts, ensuring consistent application.

Your Fund Management account gives you access to all instruments available within the fund manager’s trading portfolio. This may include forex, indices, commodities, and other supported asset classes.

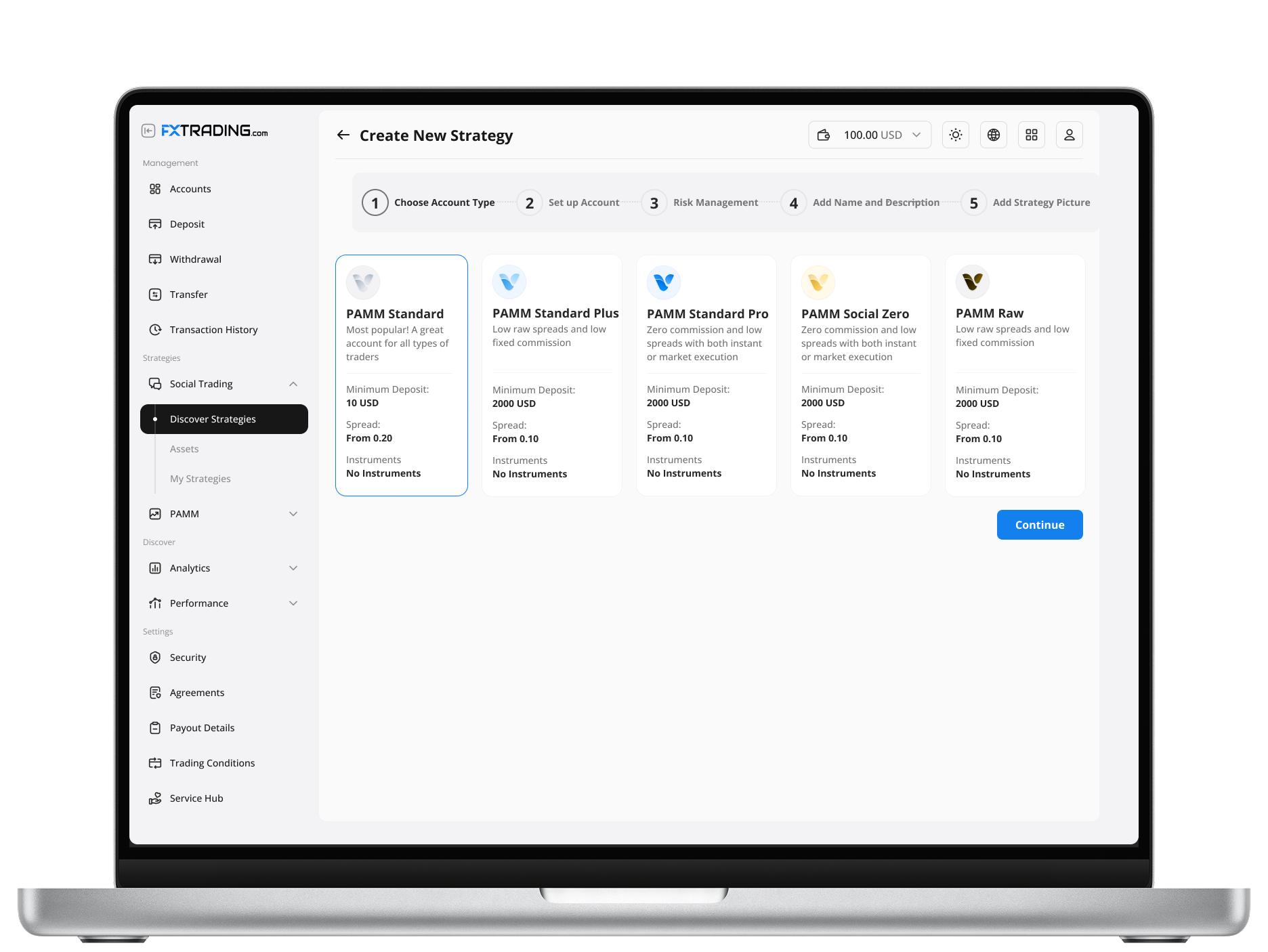

Getting started is simple. Open a live trading account with FXTRADING.com and contact our institutional support team directly through our official channels. They will guide you through the application process, discuss your specific requirements, and ensure a seamless onboarding experience.